Securing Your Assets: Count On Foundation Experience within your reaches

In today's complicated economic landscape, guaranteeing the protection and growth of your properties is extremely important. Count on structures serve as a foundation for protecting your wide range and heritage, offering a structured technique to possession defense.

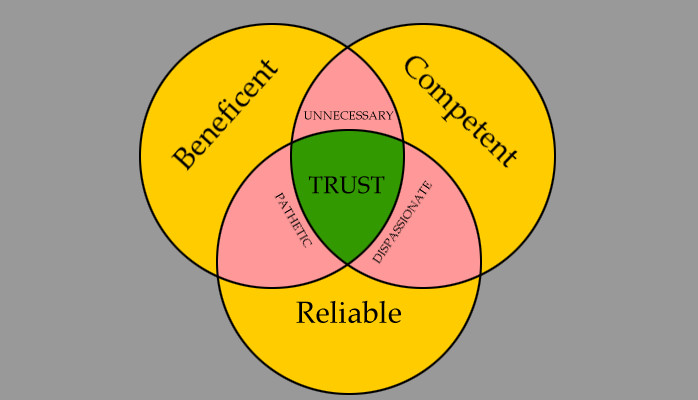

Importance of Trust Structures

Trust foundations play a vital duty in developing reputation and fostering solid partnerships in various expert settings. Trust structures offer as the keystone for ethical decision-making and clear interaction within organizations.

Benefits of Expert Guidance

Building on the foundation of rely on professional relationships, seeking specialist guidance uses vital advantages for individuals and organizations alike. Expert support gives a riches of understanding and experience that can help browse complex financial, legal, or tactical obstacles easily. By leveraging the knowledge of experts in different fields, people and organizations can make educated decisions that align with their objectives and aspirations.

One considerable advantage of expert advice is the capacity to access specialized expertise that may not be readily available or else. Experts can offer insights and viewpoints that can result in ingenious services and opportunities for growth. Additionally, working with experts can aid mitigate risks and uncertainties by giving a clear roadmap for success.

In addition, specialist advice can conserve time and sources by simplifying processes and staying clear of costly mistakes. trust foundations. Professionals can use personalized suggestions customized to certain demands, guaranteeing that every decision is knowledgeable and strategic. On the whole, the benefits of professional support are complex, making it a useful possession in safeguarding and making best use of assets for the lengthy term

Ensuring Financial Security

Making certain financial safety and security includes a multifaceted approach that incorporates numerous aspects of wide range monitoring. By spreading investments across different possession classes, such as stocks, bonds, real estate, and commodities, the danger of considerable monetary loss can be mitigated.

Furthermore, preserving a reserve is vital to secure against unforeseen expenses or income disturbances. Specialists advise setting apart three to six months' worth of living expenditures in a liquid, quickly accessible account. This fund acts as a monetary safeguard, giving comfort during unstable times.

Regularly evaluating and readjusting financial strategies in reaction to changing situations is also paramount. Life occasions, market variations, and legislative modifications can influence monetary stability, highlighting the importance of recurring examination and adaptation in the quest of lasting monetary security - trust foundations. By executing these approaches attentively and continually, individuals can strengthen their financial footing and work towards an extra safe future

Guarding Your Properties Properly

With a solid foundation in place for financial safety and security with diversification and emergency situation fund upkeep, the next important step is protecting your possessions properly. One efficient method is asset allowance, which entails spreading your financial investments across different possession classes to lower threat.

Additionally, developing a count on can offer a safe and secure method to shield your properties for future generations. Trust funds can aid you control exactly how your assets are distributed, reduce estate taxes, and protect your riches from creditors. By carrying out these methods and looking for professional suggestions, you can secure your properties properly and safeguard your economic future.

Long-Term Asset Protection

Lasting property protection entails implementing measures to guard your assets from various threats such as economic recessions, claims, or unforeseen life events. One vital facet of lasting possession security is establishing a count on, which can offer substantial benefits in securing your possessions from financial institutions and lawful disputes.

Moreover, diversifying your financial investment profile is one more web link key method for lasting possession protection. By taking an aggressive technique to lasting possession defense, you can safeguard your wealth and offer financial safety and security for on your own and future generations.

Final Thought

Finally, depend on foundations play an important function in securing possessions and making sure financial safety. Specialist advice in establishing and managing depend on frameworks is necessary for long-term possession defense. By making use of the experience imp source of experts in this area, people can properly protect their assets and strategy for the future with self-confidence. Depend on foundations give a solid structure for protecting riches and passing it on to future generations.